Considerations When Choosing Employers’ Liability Limits

by admin

Employers’ liability (EL) insurance protects your business from claims of neglect made by the employees who have suffered an injury or ill health due to their work. Unlike most other types of insurance, EL is compulsory. If your business employs workers based in England, Scotland or Wales (including offshore installations or associated structures), your business must carry EL cover to avoid significant fines.

By the law, your business is required to carry at least £5 million of EL cover. However, depending on the size and the nature of your business, the minimum level of cover may not offer adequate protection. To figure out what your EL limits may be, here are six important things to consider:

MULTIPLE CLAIMANTS:

Your EL limit applies to each claim individually. While the minimum limit should be able to handle a single claim, it’s important to keep in minds that multiple claims can emerge from a single incident. Consider whether your EL limit can handle multiple claims at once.

NATURE OF ACTIVITIES:

In general, injuries- such as loss of hearing and continuous care- tend to have larger EL claims than those involving death. Review what activities your staff regularly participate in, to better gauge the potential cost of an EL claim.

INNER LIMITS:

Your EL policy will most likely have common limitations. In general, these limitations include incidents arising from terrorism, war or nuclear risks. Learn what your policy limitations are to better insulate your business from risks.

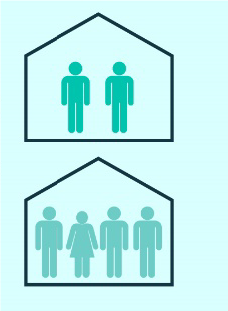

CONCENTRATION OF STAFF:

If your staff is concentrated in one main area or several smaller ones, you may need a higher EL limit, because an incident that affects one employee could affect them all.

HAZARDOUS LOCATIONS:

Some locations- such as production lines, railways, and construction sites- are more susceptible to incidents. Also, these incidents are likely to involve a greater number of people. Identify whether you have any high-risk hazardous locations.

FUTURE CIRCUMSTANCES:

An EL claim can be filed over years or even decades after an employee has ended his or her working relationship with your business (claims occurring basis). During the time between buying an EL policy and a claim being settled, much could change to affect the final settlement values. For that reason, it’s best to annually review your EL policy.

Finding the right employers’ liability policy can not only help you but also your business. If you need help in getting a quote for your policy, contact us on 0207 537 6603 or fill out our contact form.

Recommended Posts

What’s The Most Important Insurance for a Scaffolder?

July 20, 2022

Do I Have the Correct Level of Tradesman Insurance?

May 16, 2022